XYPRO Expands

Collaboration with Hewlett Packard Enterprise to Offer Full Suite of

Security Solutions on HPE NonStop Systems

LOS ANGELES, July 7, 2021 /PRNewswire/ -- XYPRO Technology Corporation (XYPRO),

a leader in delivering software solutions in cybersecurity, analytics,

identity management, and secure database management, today announced the

expansion of a decades-long partnership with Hewlett Packard Enterprise

(HPE) to deliver its entire suite through

HPE NonStop systems.

HPE NonStop systems, which tackle mission-critical environments

requiring 100% fault tolerance, are now available with expanded XYPRO

solutions for optimal threat detection and security management

capabilities.

This expansion supports XYPRO's growth strategy and extends the

availability of mission critical database management, security and

integration solutions into new markets within HPE's customer base. These

solutions help customers protect their mission-critical environment,

and, include XYPRO's flagship product -

XYGATE SecurityOne, a patented

security, compliance and threat detection platform and

XYGATE Identity Connector,

the first and only Sailpoint and CyberArk integrations for HPE NonStop

systems. Customers can now meet requirements to secure and monitor their

mission-critical investment with these solutions using HPE NonStop

systems.

"In our history of delivering risk

management solutions for HPE NonStop systems customers longer than

anyone has, we strive for meaningful and strategic business

relationships while providing great support and leading edge security

solutions. Our strong relationship with HPE is why several XYPRO

solutions have shipped with the HPE NonStop operating system for more

than a decade," said Lisa Partridge, CEO, XYPRO. "Making the rest of the

XYPRO's solution suite available through HPE further strengthens

security within the HPE NonStop system ecosystem, providing customers

security and consistency at significant value."

Read More Here…

HPE NonStop(tm)

Migration Partner

Contact us

Newsletters

Missed a Newsletter? Catch Up

Here

Find out about

Tandemworld

Gravic Publishes New Technical Brief on

HPE Shadowbase Mapping Facility (SBMAP)

Gravic recently published a

new technical brief on

HPE

Shadowbase Mapping Facility (SBMAP),

which is

a SQL-like scripting facility for transforming large

data sets. Transforming data is critical in today’s IT landscape. To

remain competitive, enterprises must collect, extract, and analyze

real-time data in various parts of the organization simultaneously.

Transforming large datasets is daunting, whether for migration,

real-time analysis, database administration, or another reason.

Shadowbase User Exits have

long been a feature to embed custom logic into the replication engine.

Prior to SBMAP, all data mapping logic had to be manually programmed as

a User Exit. Now, SBMAP

automatically transforms in-flight data as it is

replicated and defines data mapping logic without the need to write

custom C, C++, or COBOL Shadowbase User Exits, by using a familiar and

intuitive SQL-like syntax. Designed to work and feel like SQL/MP, SBMAP

makes transforming large data sets easier than ever before.

SBMAP is sold as part of the

HPE Shadowbase Essentials Software Bundle that includes several

utilities to monitor, manage, and control your Shadowbase environments.

For additional information on SBMAP, please

visit our website or

contact us.

Hewlett Packard Enterprise

globally sells and supports Shadowbase solutions under the name HPE

Shadowbase. For more information, please contact your local HPE

Shadowbase representative or

visit our website. For additional information, please view our

Shadowbase solution videos:

https://vimeo.com/shadowbasesoftware.

Specifications subject to

change without notice. Trademarks mentioned are the property of their

respective owners. Copyright 2021.

XYPRO presents at CTUG, BITUG

and HPE DISCOVER 2021

It’s been a busy and exciting time for the HPE Community with virtual

events by CTUG, BITUG and HPE Discover.

XYPRO Account Executive Steve Roy presented “Multi-Factor Authentication

for HPE NonStop” at BITUG covering how XYGATE User Authentication (XUA)

– included with your HPE NonStop server – provides multi-factor

authentication to strengthen the security of your servers AND

applications. XUA enables regulatory compliance with PCI-DSS, GDPR,

HIPAA and more. THis enables you to secure your environment against

authentication attacks using the tools you already have.

Click here to watch the presentation

In addition to our participation at BITUG, XYPRO’s Chief Product Officer

Steve Tcherchian

presented an informative talk on ” Enterprise Integration of Your HPE

NonStop Ecosystem” at the CTUG Virtual Conference.

You can watch the video by clicking here.

Rounding out a very busy time, Steve Tcherchian and XYPRO product

analyst Zuhra Rahyab also created an on-demand presentation for HPE

Discover 2021 entitled “What is Zero Trust Security Anyway?". Zero trust

is a “never trust, always verify” model and Steve explains how it can

reduce your vulnerability footprint.

Click here to view the presentation.

Read More Here...

IT Software Firm Kaseya Falls Victim to Ransomware Attack

Software maker Kaseya Limited urged users of its VSA endpoint management

and network monitoring tool to immediately shut down VSA servers to

prevent them from being compromised in a widespread ransomware attack.

The cyberattack exploited a zero-day vulnerability in the product.

According to Kaseya, the attack began around 2:00 pm ET on Friday, July

2.

Businesses around the world rushed to contain the ransomware attack that

paralyzed their computer networks. The timing of the attack does not

seem to be a coincidence, as IT and security teams were likely

understaffed and slower to respond due to the 4th of July holiday

weekend in the United States.

There

is no information yet regarding the number of organizations affected by

ransom demands to get their systems working again. However, some

cybersecurity researchers predict the attack targeting customers of

software supplier Kaseya could be one of the broadest ransomware attacks

on record.

The

cybersecurity firm ESET says there are victims in at least 17 countries,

including the United States, United Kingdom, South Africa, Canada,

Argentina, Mexico, and Germany.

The

attack appears to have exploited a zero-day vulnerability and delivery

of a malicious Kaseya VSA software update. The update delivered a piece

of ransomware that encrypted files on compromised systems. The hackers

appear to have leveraged an authentication bypass flaw affecting the VSA

web interface to upload the malicious payload. They were then able to

execute arbitrary code on compromised systems.

Who was Behind the Attack?

Cybersecurity experts say the REvil gang, a major Russian-speaking

ransomware syndicate, appears to be behind the attack that targeted

Kaseya. The attack used Kaseya's network management package as a conduit

to spread the ransomware through cloud-service providers.

The

REvil ransomware was also used recently in an attack aimed at meat

packaging giant JBS, which paid $11 million to the hackers to ensure

that the files they stole would not be made public.

The

number of impacted Kaseya customers is relatively small. However, their

products are also used by managed service providers (MSPs), and the

attackers were able to deliver the ransomware to the customers of those

MSPs.

Coop,

a Swedish grocery chain whose POS supplier uses an MSP affected by the

Kaseya attack, was forced to close down a majority of its 800 stores.

This

is just the latest in a string of recent cyberattacks, following the

SolarWinds hack and JBS ransomware attack from earlier this year. The

importance of a robust cybersecurity strategy has never been more

evident.

Reduce Security Vulnerabilities with

Multi-Factor Authentication

Modern authentication methods represent a more robust security structure

than simple passwords. They also provide a better user experience when

logging into applications. MFA makes it easier for auditors to get

answers to critical compliance questions. MFA provides valuable

information, such as which users are granted access to which system and

how the access policy is enforced. Additionally, some of the modern MFA

applications available today also include reporting capabilities. That

ensures that compliance standards, such as PCI-DSS, are met.

CSP Authenticator+®

supports numerous authentication factors for NonStop. It provides a

RESTful interface that supports multi-factor authenticated logins on

NonStop systems. CSP Authenticator+ resides on the NonStop Platform and

uses an OSS “bridge” to connect to the RESTful interface of the CSP

Authenticator+ web server.

CSP Authenticator+

provides authentication services via Safeguard Authentication SEEP, or

Pathway and Non-Pathway servers. Almost any application, including TACL,

can now easily support multi-factor authentication (MFA).

Authentication methods

such as RADIUS, RSA Cloud, Active Directory, and Open LDAP are

supported. Additional authentication methods

include RSA SecurID, Email, Text Message, and Google Authenticator. You

can now enable MFA logins for different

applications, making them more secure!

CSP Authenticator+ Key Features:

·

Support for

various authentication methods

·

Browser-based

user-friendly interface

·

Standardized

authentication across platforms

·

Configurable for

all or selected users

·

Support for

virtual addressing

CSP - Compliance at your

Fingertips®

For complimentary access to

CSP-Wiki®, an extensive repository of NonStop security knowledge and

best practices, please visit

wiki.cspsecurity.com

We Built

the Wiki for NonStop Security

®

The CSP Team

+1(905)

568 –8900

How has

consumer behaviour changed in Latin America?

We shine a different light this month

on the shape of the changing payments landscape in Latin America. We

were delighted to be joined by Emilio Vasquez who as Visa’s executive

director of solutions for merchants and buyers, gave us an interesting

insight into how consumer behaviour is evolving in his region, and in

particular in Colombia, Mexico, & Chile.

The presentation aimed to address one

other key question. What are the Fraud Trends in the post-covid payment

processing industry.

“Today we are interested in focusing

on those behavioural changes that affect technology in the payments

industry.

Let's see that it is not surprising

that the behaviour of the final consumer has challenged the projections

that were made and experienced across 2020 and 2021. Of course, these

behaviours vary depending on the segments of the population.

Still, the available projections in

Latin America focus on In what has been called the "Affluent Consumer" -

this is an attractive segment for commerce due to its purchasing power

since it currently owns 16% of global wealth.

The pandemic radically changed the

lifestyle and consequently the shopping habits of consumers. Now, some

temporary trends are becoming more visible. Under Visa research

published within numerous reports, we can list some six trends in

consumer behaviour, transforming the landscape for merchants, issuers

and acquirers.

(1) The first is the use of

technology in everyday life; communications, telework, telemedicine,

video games, what we already know. But mainly the disruption of

electronic commerce.

The pandemic situation immensely

helped people who felt mistrust when making digital payments were

tempted to try these channels and assess their benefits in online

shopping.

Studies by the consulting firm

E-marketer show that there was a 30% increase in digital commerce in

Latin America last year. These figures are fascinating, especially in

Latin America, a region with a high degree of informality and a

preference for cash.

(2) Second, consumer experience

assessment, which has been gaining momentum for a few years, deepened in

the pandemic. The experience of a secure payment now not only includes

protection against fraud but also protection against contagion.

Market research projections support

that this psychological sensation will persist over time, such as

increased consumer awareness of contact. Without a doubt, this is a

challenge for new payment technologies and an opportunity for e-commerce

and digital payments in general.

(3) The third trend results from a

consumer with a more refined criterion of trust, evaluating, punishing

or rewarding brands with their loyalty. Market surveys show that 71% of

consumers during the pandemic will withdraw their support from brands

that are more focused on their profits than on people or opportunists.

(4) Fourth, a marked preference for

local shopping, as a result of an ethical reflection in consumers on the

economic losses of local merchants and is also a practical adaptation to

the difficulties of distribution and delivery times.

We are left with two trends in

consumer behaviour affecting the payments industry and the rise of

e-commerce.

(5) One is that the internet became

the centre of entertainment and learning during the first months of the

pandemic. According to preliminary data, it is estimated that visits to

the extensive network increased between 50% and 70%. This situation

creates a sea of opportunities

for e-commerce and innovation in digital payments.

(6) And the last trend of the

panorama that the VISA reports show us, has been cultivated in recent

decades. Still, it has deepened with the pandemic and is the high

valuation of comfort, trust, and well-being of the Visa brand and the

differentiation that brings to its membership. This also shapes the

needs of consumers in the personalization of payment experiences.

In summary, these trends accelerated

by psychological situations of a scarcity mentality, social awareness

and economic uncertainty, configure challenges for the different players

in the payment industry, which based on the research of VISA and market

consultants, we summarize as follows;

In the operations of the merchants,

it is a priority now; digitize payments, have an online presence, drive

the customer experience and enable B2B payments.

For their part, acquirers have needed

to renew their digital offerings. Multi-acquiring models that allow

accepting a set of digital payment methods no matter who processes them

are gaining relevance worldwide. In this way, the supplier's selection

would be more transparent and based on the needs of the consumer.

Acquirer operations face challenges

in creating and offering full-stack solutions, reducing acceptance paths

and facilitating merchant activity, paying more attention to long-tail

digital merchants, and enabling B2B payments faced with the restrictions

of the pandemic.

As for issuers, they play an even

more competitive role in the post-covid landscape, especially amid the

proliferation of financial technologies. With the growing demands of a

more digitized post-pandemic consumer, the challenges for banks are to

reinvent themselves to meet greater demand for personalization and

closeness in people's lives. Also, investment in technology departments

is crucial to offer the client much more than the possibility of opening

an account through an app.

And

finally, partnerships with traditional players (banks) and new ones (fintech

startups) will make a difference in the offers, the acquisition of new

clients and the distribution of the products. In sum, the challenges for

issuers are personalization, investment in technology and strategic

partnerships.”

In the final closing section, Sergio

Vera, OmniPayments VP Cloud Operations concluded the session with the

following :

“To end this section, we know that

players in the industry must stay up-to-date on these changes to

anticipate and optimize their operations. For this reason, we will close

this webinar with the experience and feedback we obtain through our

presence in various regions.

Faced with this scenario, where

established players and incumbent players have to coexist in the same

ecosystem, we have found on the one hand, traditional players who are

not yet going at the required speed as demanded by this new normal.

At the other end of the spectrum,

incumbent players face the operational complexity of the ecosystem, that

is compliance with regulations, chargebacks, acceptance, & risk

management.

This complexity requires expertise,

and investments are regularly faced in the medium and long term to

address these compliance issues.

At OmniPayments operating hand in

hand with our partner Visa, we have transformed our payment solutions to

be a link between both traditional and new players, generating

technological and business models that favour access to large

infrastructures and expertise of means of payment.

Together we extend from the

acceptance, authorization, and prevention of fraud with an efficient

cost that provides business value to each client's respective size and

particular complexity.

HPE & LUSIS PARTNERSHIP OFFERS

GREENLAKE FOR CORE PAYMENT SYSTEMS

For organizations looking

for ways to modernize their payment system experience, HPE is

introducing HPE GreenLake for Core Payment Systems in partnership with

Lusis. With this solution, customers benefit from complete payment

solutions, pay per transaction, a platform that supports contactless

payments, and easy to maintain compliance – all with the cloud

experience. This builds on the momentum and market footprint for the HPE

GreenLake cloud platform which today serves hundreds of banks and

financial institutions around the world.

“Partnering with HPE has been a critical part of our growth and success

as we expand into international markets,” said Philippe Préval,

President and CEO, Lusis. “And today, four of the ten biggest banks in

the world are using Lusis payment systems. As more of our clients seek

out cloud features and services on demand, HPE GreenLake allows us to

offer them our world-class payment solution, delivered as a service,

wherever their apps and data reside.”

Read the entire Press Release from HPE

Watch 2021

HPE DISCOVER interview with Philippe Préval - President /CEO of Lusis

To

learn more about HPEGreenLake for Retail Payment Systems visit

www.lusispayments.com/hpe-greenlake or contact Brian Miller at

Brian.Miller@lusispayments.com.

Brian Miller

General Manager

Lusis Payments

www.lusispayments.com

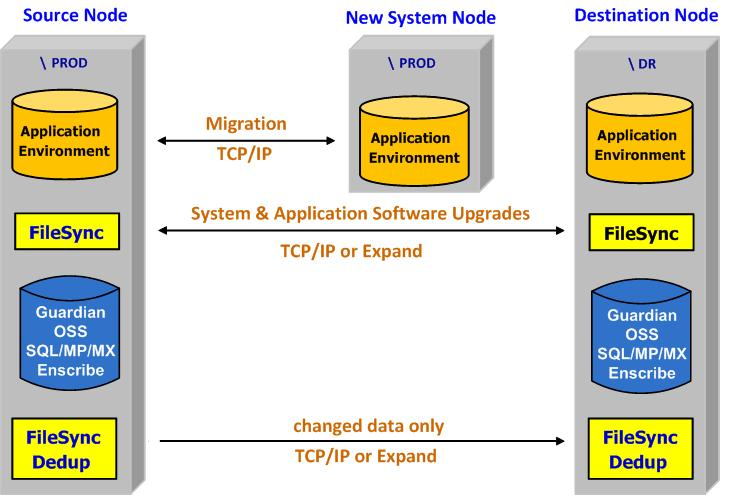

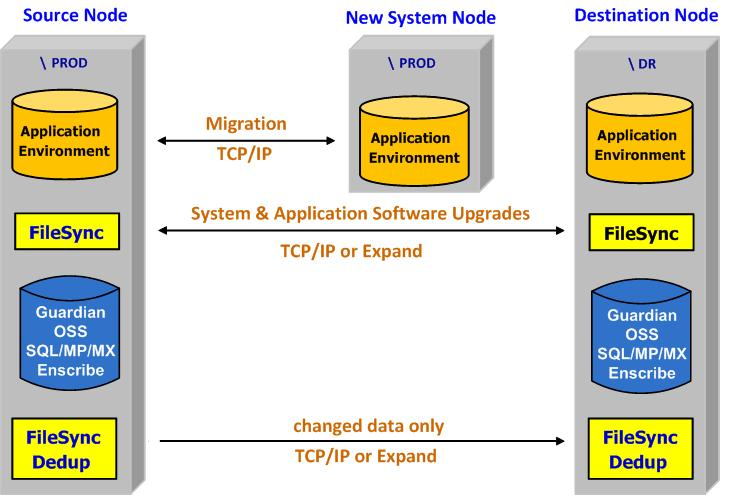

TANDsoft’s FileSync is

a Disaster-Recovery Alternative to Tape

FileSync is one of TANDsoft’s

feature-rich flagship products. Customers over the years have employed

the solution for the automatic monitoring, replicating, and

synchronization of application environments (source files, program

files, configuration files). FileSync works closely with existing HPE

NonStop data replication partners. It also is valued for its ability to

asynchronously update large database files between NonStop servers.

This particular FileSync feature is useful because it is so much faster

than FileSync’s competition. That speed dramatically reduces network and

synchronization times from hours to minutes by capturing and then

restoring only changed data, not entire files. Redundant data is not

transmitted. As such, FileSync is a perfect DR strategy for those

companies eager to move off physical and/or virtual tape for the

purposes of Disaster Recovery.

Our competition measures network

and synchronization times in hours. TANDsoft reduces that time to

minutes by synchronizing only data block differences, not whole files.

TANDsoft’s Block Hash Compare technology is what makes FileSync as a

disaster-recovery strategy blazing fast. It detects changes to an

already replicated file and streams to a backup database only data

blocks that have changed within a file or database. No more whole file

backup. As a result, both bandwidth requirements and file

synchronization performance are greatly improved.

Using FileSync for disaster recovery works with all files but is

particularly useful with large unaudited files, where tape’s whole file

backup and restore process can take hours and often limits the appeal to

backing up data on a more frequent basis. Several TANDsoft customers

have replaced their tape-based DR strategies with FileSync as well as

taking advantage of FileSync’s many other features. They include:

- Supports both TCP/IP and Expand transport protocols

- Supports OSS files and all Enscribe files

- Supports SQL/MP and SQL/MX

- Multiple copies of FileSync can coexist in the same NonStop server,

with each copy

serving a different business unit

- Preserves node-centric settings

- Supports triggers

- Offers automatic or scheduled file synchronizations

- Supports qualified expressions and discrepancy reporting

- Provides numerous reports – current and historical statistics

available

- Uses TCP/IP to migrate current system to new system with same node

name

- TANDsoft offers free trials

FileSync is certified on all HPE NonStop servers and requires zero

application modifications. For information on FileSync, visit https://tandsoft.com/pdf/FileSync.pdf.

Companion products to FileSync are FS Compare and Repair and FS Backup

and Restore.

FS Compare and Repair identifies, reports, and resolves rows, records,

columns and field discrepancies in HPE NonStop Enscribe files, OSS

files, and SQL tables. It is the most rapid compare/repair product for

use in the HPE NonStop environment because it uses block hash compare

technology. It can compare a 1 terabyte multi-partitioned file in just

10 minutes. Thirteen seconds is all it takes to compare 10 million

records.

Whereas other NonStop comparison products compare source and target

files at the record-to-record level, FS Compare and Repair compares

source and target files via blocks to determine if the corresponding

blocks are equal. If a file has five million records and only one

million blocks, less time required to compare leads to faster speeds. FS

Compare and Repair’s Version 3 offers a new ingredient – it addresses

data discrepancies not only between “apples-to-apples” source and target

databases but also between “apples-to-bananas” source and target

databases. It allows HPE NonStop customers to compare any of their

database files regardless of physical file structure.

Like FileSync and FS Compare and Repair, FS Backup and Restore also

incorporates block hash compare technology to reduce backup times from

hours to minutes by detecting file data-block modifications, archiving

only the changes, then retrieving and applying the modifications to

rebuild the original file. FS Backup and Restore complements HPE NonStop

Backup and Restore utilities as well as all third-party storage

solutions. It has no competitor in the HPE NonStop environment.

Learn more about any or all TANDsoft products by contacting Jack Di

Giacomo (+1 514-695-2234 / jack.digiacomo@tandsoft.com) or Dieter

Orlowski (+1 303-263-4381 / dieter.orlowski@tandsoft.com).

TANDsoft is a global provider of innovative HPE NonStop software

solutions for use in time virtualization, application modernization,

security, and business continuity. Many NonStop customers use our

intercept technology to enhance application functionality with no

program modifications or even in the absence of source code. Check us

out at

www.tandsoft.com.

Ask TandemWorld

Got a question about NonStop ? ASK Tandemworld

Keep up with us on

Twitter @tandemworld

We are currently seeking skilled resources across the EMEA region,

contact us for More Info

www.tandemworld.net

Find out more about us at

www.tandemworld.net